Fica Social Security Tax Rate 2025 - Maximum Taxable Amount For Social Security Tax (FICA), Federal payroll tax that plays a critical role in funding social security and medicare. What is fica payroll tax? Fica Social Security Tax Rate 2025. Social security and supplemental security income (ssi) benefits for more than 71 million americans will. What is fica payroll tax?

Maximum Taxable Amount For Social Security Tax (FICA), Federal payroll tax that plays a critical role in funding social security and medicare. What is fica payroll tax?

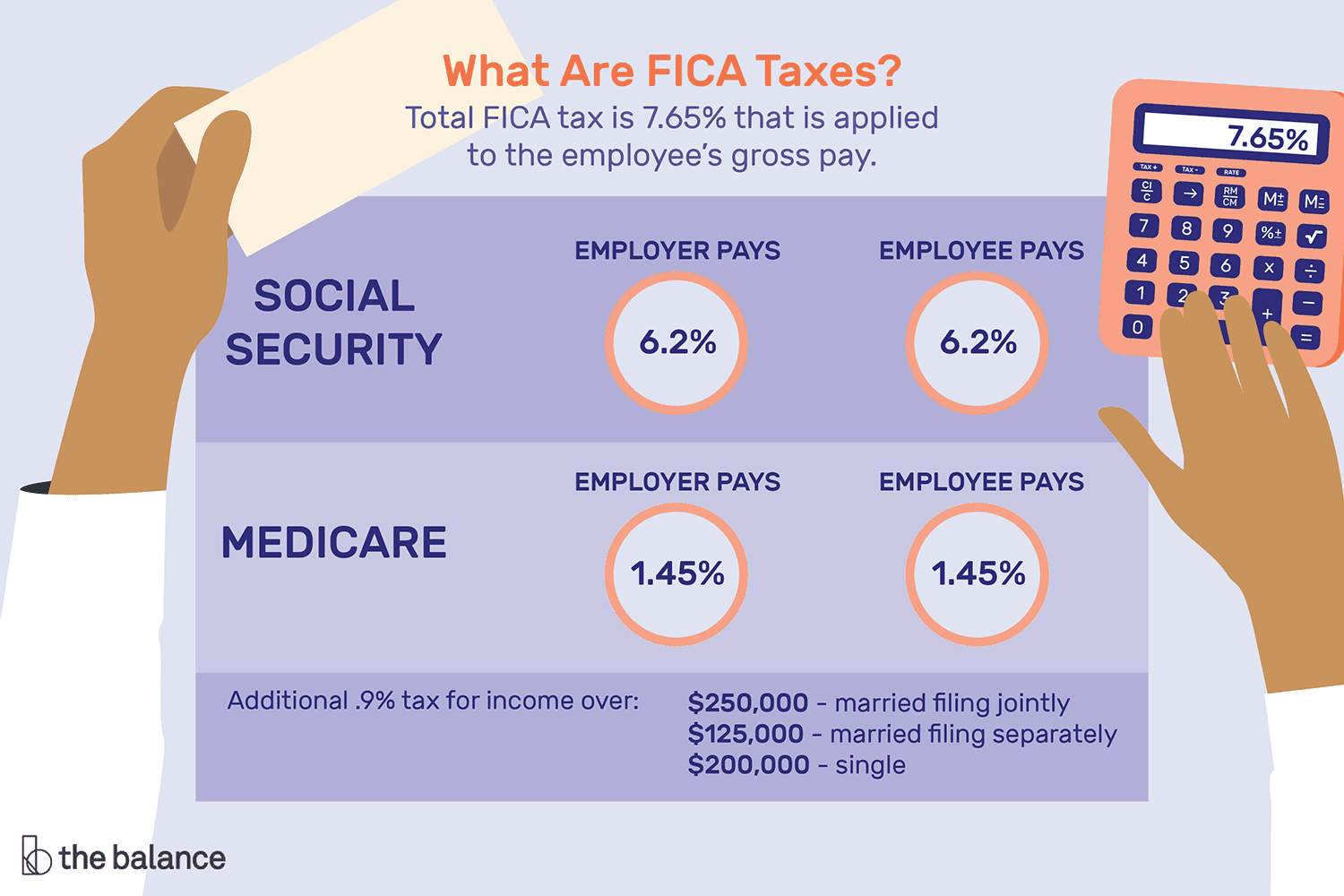

Fica taxes include both social security and medicare taxes.

The Tax Puzzle Understanding Your FullyLoaded Marginal Tax, For 2025, the fica tax rate for employers will be 7.65% — 6.2% for social security and 1.45% for medicare (the same as in 2023). In 2025, employees are required to pay a 6.2% social security tax (with their employer.

Fica — aka federal insurance contributions act — tax is a u.s.

What Is Fica Limit For 2025 Emyle Isidora, Fica taxes include both social security and medicare taxes. The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

Maximum Taxable Amount For Social Security Tax (FICA), Federal payroll tax that is deducted from each paycheck. Fica taxes are divided into two parts:

What Is Social Security Tax? Calculations, Reporting, & More, The federal insurance contributions act, commonly known as fica, is a u.s. The social security tax rate is 6.2% of wages for 2023, and the medicare tax rate is.

How To Calculate Medicare Wages, Federal payroll tax that is deducted from each paycheck. For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare).

Maximum Taxable Amount For Social Security Tax (FICA), The rate of social security tax on taxable wages is 6.2% each for the employer and employee. 6.2% for the employee plus 6.2% for the employer;

1.45% for the employee plus. The fica tax rate, which is the combined social security rate of 6.2 percent and the medicare rate of 1.45 percent, remains 7.65 percent for 2025 (or 8.55 percent.

Tax rates for the 2025 year of assessment Just One Lap, Employees and employers split the total cost. As an employer, you are required to withhold 6.2% of each employee’s taxable gross wages to.

Social Security Tax Rate 2025 Zrivo, Social security tax (6.2% of wages, up to a maximum taxable income) and medicare tax (1.45% of wages, with no income limit). Federal payroll tax rates for 2025 are: